Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material | |

| Knoll, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

1235 Water StreetEast Greenville, PA 18041Tel 215 679-7991Fax 215 679-1013

March 23, 2016

Dear Stockholder:

We cordially invite you to attend our 2016 Annual Meeting of Stockholders to be held at 9:00 a.m. (local time) on Wednesday, May 4, 2016 at our offices located at 1330 Avenue of the Americas, 2nd Floor, New York, New York 10019. The attached notice of Annual Meeting and proxy statement describe the business we will conduct at the meeting and provide information about Knoll, Inc. that you should consider when you vote your shares.

When you have finished reading the proxy statement, please promptly vote your shares via the Internet, via the telephone or by marking, signing, dating and returning a proxy card. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your cooperation.

Sincerely,

![]()

Andrew B. CoganChief Executive Officer

![]()

1235 Water StreetEast Greenville, PA 18041Tel 215 679-7991Fax 215 679-1013Notice of Annual Meeting of Stockholders

KNOLL, INC.NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS When

To the Stockholders of Knoll, Inc.:May 8, 2018TIME: 9:00 a.m. (local time)DATE: Wednesday, May 4, 2016Eastern Time

Knoll, Inc.,

1330 Avenue of the Americas, 2nd Floor, floor

New York, New York 10019

YouStockholders of record as of the close of business on March 15, 2018, are entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof if you were the record owner of Knoll, Inc. common stock at the close of business on March 15, 2016.Meeting. A list of stockholders of record will be available at the meeting and during regular business hours for the 10 days prior to the meeting at our offices at 1330 Avenue of the Americas, 2nd Floor, New York, New York 10019. A stockholder may examine the list for any legally valid purpose related to the meeting.

BY ORDER OF THE BOARD OF DIRECTORSBy Order of the Board of Directors,

Michael A. Pollner

Senior Vice President, Chief Administrative Officer, General Counsel and& Corporate Secretary

March 23, 201629, 2018

Important Notice Regarding the Availability of Proxy Materials for

the

Stockholders Meeting to Be Held on May 4, 20168 2018:

The proxy statement and annual report to stockholders are available at www.edocumentview.com/KNL

Proxy Statement Summary

The Board of Directors ("Board") of Knoll, Inc. (the "Company," "we," "us," "our" or "Knoll") is furnishing this proxy statement and soliciting proxies in connection with the proposals to be voted on at the Knoll, Inc. 2018 Annual Meeting of Stockholders ("Annual Meeting") and any postponements or adjournments thereof. This summary highlights certain information contained in this proxy statement, but does not contain all of the information you should consider when voting your shares. Please read the entire proxy statement carefully before voting.

| | | | | | | |

| | 2018 Annual Meeting Information | | | |||

| | | | | | | |

| Date | May 8, 2018 | |||||

| | | | | | | |

| Time | 9:00 a.m. (Eastern Time) | |||||

| | | | | | | |

| Location | Knoll, Inc. 1330 Avenue of the Americas, 2nd floor New York, New York 10019 | |||||

| | | | | | | |

| Record Date | March 15, 2018 | |||||

| | | | | | | |

| Stock Symbol | KNL | |||||

| | | | | | | |

| Stock Exchange | New York Stock Exchange ("NYSE") | |||||

| | | | | | | |

| Corporate Website | www.knoll.com | |||||

| | | | | | | |

Voting Matters And Vote Recommendation

| PROPOSAL | BOARD RECOMMENDATION | REASONS FOR RECOMMENDATION | MORE INFORMATION | |||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| 1. | Election of 3 director nominees named in our proxy statement to our Board of Directors for three-year terms | FOR | The Board and the Nominating and Corporate Governance Committee believe our nominees possess the skills, experience and qualifications to effectively monitor performance, provide oversight and support management's execution of the Company's long-term strategy. | Page 10 | ||||

| | ||||||||

| 2. | Approval of the Knoll, Inc. 2018 Stock Incentive Plan | FOR | We believe that equity incentives are critical in attracting and retaining talented employees. | Page 24 | ||||

| | ||||||||

| 3. | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2018 | FOR | Based on its assessment, the Audit Committee believes that the re-appointment of Ernst & Young LLP is in the best interests of Knoll and our stockholders. | Page 34 | ||||

| | ||||||||

| 4. | "Say on Pay" advisory vote on 2017 executive compensation | FOR | Our executive compensation program incorporates several compensation governance best practices and reflects our commitment to paying for performance. | Page 35 | ||||

| | ||||||||

For over 80 years, Knoll has stood for modern design. Our focus is on design leadership, quality and innovation in both the contract and residential markets. Four strategic imperatives drive our growth:

Knoll is

Modern Always

because modern

always works.

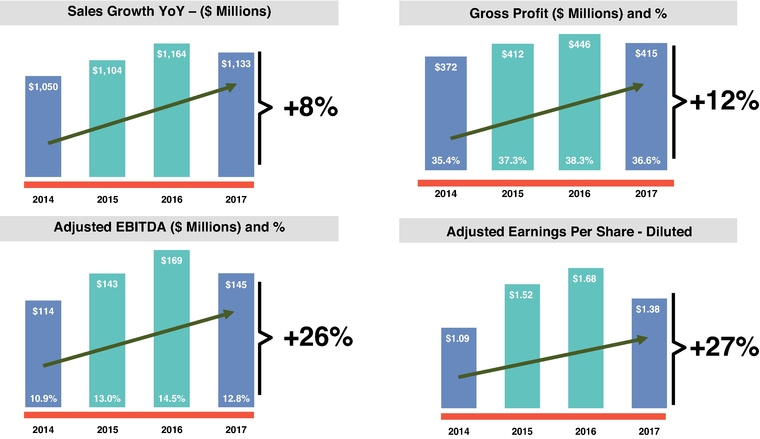

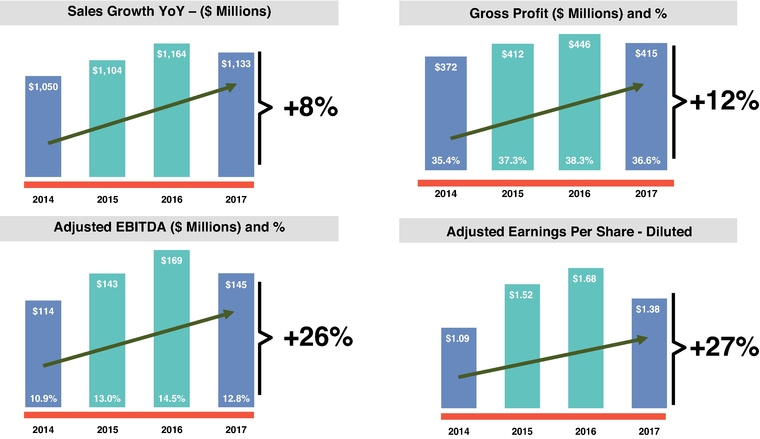

Our strategy and compensation systems have generated significant growth in our sales, margins and profits; however, 2017 represented a pause in our overall improvement:

Note: Adjusted EBITDA and Percentage, and Adjusted EPS are non-GAAP financial measures. For a reconciliation of Net Earnings to Adjusted EBITDA and Percentage and Adjusted EPS to GAAP EPS, see page 74.

We encourage you to review our Annual Report to Shareholders accompanying this proxy statement for more complete financial information.

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL1 | | ELECTION OF DIRECTORS | |||||

| | | | | | | | | |

| | | | |

Our board of directors currently consists of eleven members, classified into three classes. In Proposal 1, stockholders are asked to vote "FOR" the following Class II directors, who have terms that expire at the 2018 Annual Meeting.

| Board Committee Assignments | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Director Since | Independent | Audit | Compensation | Nominating and Corporate Governance | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Stephanie Stahl | 2013 | Yes | ✓ | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Christopher G. Kennedy | 2014 | Yes | ✓ | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Daniel W. Dienst | 2017 | Yes | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Committee membership is as of the date of this proxy statement. Current committee assignments are indicated by a (✓), and committee chairs are indicated by "Chair." Please see pages 10 through 16 for more information regarding our director nominees. Burton B. Staniar and Sidney Lapidus, current Class II directors, will not serve beyond the 2018 Annual Meeting.

| Name | Age | Director Since | Independent? | Term Expires | Audit | Compensation | Nominating | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | |

Kathleen G. Bradley | 68 | 1999 | Yes | 2019 | ||||||||||

Andrew B. Cogan (CEO and Chairman-Elect) | 55 | 1996 | No | 2020 | ||||||||||

Daniel W. Dienst | 52 | 2017 | Yes | 2018 | ||||||||||

Stephen F. Fisher | 65 | 2005 | Yes | 2020 | Chair | |||||||||

Jeffrey A. Harris (Lead Director) | 62 | 1996 | Yes | 2019 | Chair | |||||||||

Christopher G. Kennedy | 54 | 2014 | Yes | 2018 | ||||||||||

Sidney Lapidus | 80 | 1996 | Yes | 2018 | ||||||||||

John F. Maypole | 78 | 2004 | Yes | 2019 | Chair | |||||||||

Sarah E. Nash | 64 | 2006 | Yes | 2020 | ||||||||||

Stephanie Stahl | 51 | 2013 | Yes | 2018 | ||||||||||

Burton B. Staniar (Chairman) | 76 | 1993 | No | 2018 |

Diversity is one of the factors considered by our nominating and corporate governance committee in the director nomination process. Among the factors considered when we evaluate the skills, experiences and perspectives of our directors are the following: (i) financial and accounting acumen; (ii) educational background; (iii) knowledge of our industry and related industries; (iv) personal and professional integrity; (v) business or management experience; (vi) crisis management experience; (vii) leadership and strategic planning experience; and (viii) brand development and consumer marketing. We also consider diversity with respect to race and gender in evaluating whether the board as a whole has the right mix of perspectives to properly serve the company and its stockholders.

| | | | | |

Size of the Board of Directors | 11** | |||

Number of Independent Directors | 9 | |||

Audit, Compensation and Governance Committees Consist Entirely of Independent Directors | Yes | |||

Lead Independent Director of the Board | Yes | |||

Majority Voting Resignation Policy in Uncontested Director Elections | Yes | |||

Annual Advisory Approval of Named Executive Officer Compensation | Yes | |||

All Directors Attended at Least 75% of Meetings Held | Yes | |||

Annual Board and Committee Self-Evaluations | Yes | |||

Code of Ethics | Yes | |||

Stock Ownership Guidelines for Executive Officers and Directors | Yes | |||

Clawback Policy | Yes | |||

Stockholder Rights Plan (Poison Pill) | No | |||

| | | | | |

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL 2 | | Approval of the Knoll, Inc. 2018 Stock Incentive Plan | |||||

| | | | | | | | | |

| | | | |

On February 6, 2018, our board of directors approved for submission to a vote of the stockholders the Knoll, Inc. 2018 Stock Incentive Plan (the "2018 Plan") and submits the 2018 Plan to our stockholders for approval. We believe that equity incentives are critical in attracting and retaining talented employees in our industry. The approval of the Knoll, Inc. 2018 Stock Incentive Plan will allow us to continue to provide such incentives.

The 2018 Plan includes the following key features:

See page 24 for more details regarding the Plan. A copy of the 2018 Plan is set forth in Exhibit B to this proxy statement and is incorporated herein by reference.

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL 3 | | RATIFICATION OF APPOINTMENT OF AUDITORS | |||||

| | | | | | | | | |

| | | | |

Ernst & Young LLP, independent registered public accounting firm, served as our auditors for fiscal 2017. Our Audit Committee has selected Ernst & Young LLP to audit our financial statements for fiscal 2018. Although it is not required to do so, the board is submitting the Audit Committee's selection of our independent registered public accounting firm for ratification by the stockholders at the annual meeting in order to ascertain the view of our stockholders regarding such selection. Below is summary information about Ernst & Young's fees for services during fiscal years 2017 and 2016:

| | 2017 | 2016 | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Audit Fees: | $ | 1,990,588 | $ | 1,742,357 | |||

Audit-Related Fees: | | 0 | | 80,805 | |||

Tax Fees: | | 0 | | 0 | |||

All Other Fees: | | 1,995 | | 2,000 | |||

| | | | | | | | |

Total | $ | 1,992,583 | $ | 1,825,162 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL 4 | | ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | |||||

| | | | | | | | | |

| | | | |

Our Executive Compensation Program

We provide our stockholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the rules of the Securities and Exchange Commission ("SEC"). The vote on this resolution is not intended to address any specific element of compensation; rather, the advisory vote relates to the overall compensation of our named executive officers, as well as the philosophy, policies and practices, all as described in this proxy statement in accordance with the SEC's rules. The vote is advisory, and therefore it is not binding on the company, the compensation committee or our board of directors. We recommend that our stockholders vote "FOR" approval of our executive compensation as described in this proxy statement.

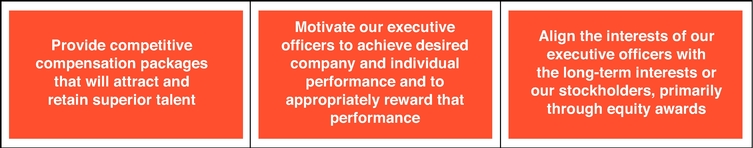

Our executive compensation programs are generally designed to:

We believe that motivating and rewarding exceptional performance is the overriding principle of our executive compensation programs.

| WE DO: | WE DO NOT: | |||||

| ✓ | Provide a significant portion of our named executive officers' total compensation in the form of awards tied to our long-term strategy and our performance. | ✘ | Have employment agreements or change of control agreements with our named executive officers other than Mr. Cogan, and that agreement has an annual term. | |||

| | | | | | | |

| ✓ | Require compliance with our Stock Ownership Guidelines, which require that our executive officers own a specified value of shares of the Company's common stock. | ✘ | Provide tax gross-ups for our named executive officers. | |||

| | | | | | | |

| ✓ | Have a Compensation Committee comprised entirely of independent directors who use an independent consultant retained by the Compensation Committee. | ✘ | Time the grants of equity awards to coordinate with the release of material non-public information, or time the release of material non-public information for the purpose of affecting the value of any named executive officer compensation. | |||

| | | | | | | |

| ✓ | Have ongoing consideration and oversight by the Compensation Committee with respect to any potential risks associated with our incentive compensation programs. | ✘ | Provide material executive perquisites such as corporate aircraft, executive life insurance, tax or estate planning services. | |||

| | | | | | | |

| ✓ | Operate a Clawback Policy for Section 16 Officers which permits the Company to recover excess incentive compensation in the event of a restatement. | ✘ | Provide supplemental retirement benefits to our executive officers | |||

| | | | | | | |

| ✓ | Prohibit our associates through our Insider Trading Policy from engaging in hedging transaction in our stock | ✘ | Operate deferred compensation plans for our executive officers. | |||

| | | | | | | |

| ✓ | Utilize "double trigger" change-in-control provisions in our equity award agreements for awards made after August 2016, | ✘ | Operate a stockholder rights plan (Poison Pill). | |||

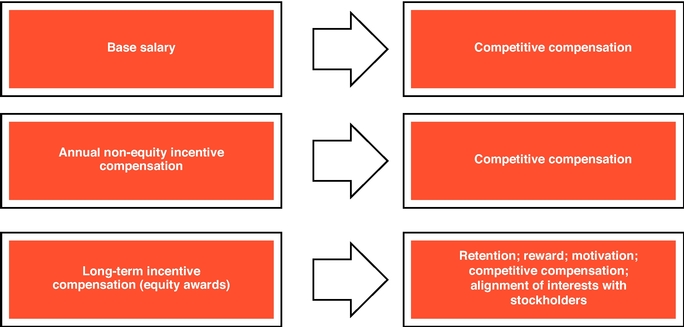

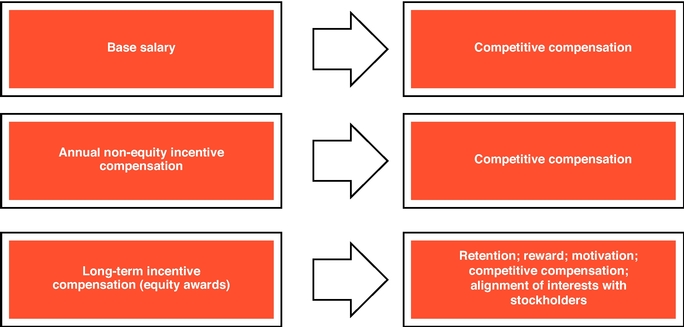

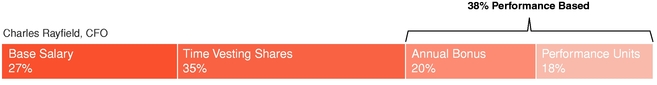

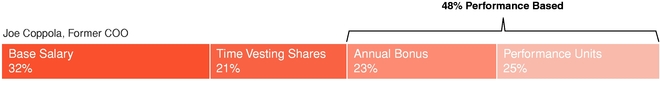

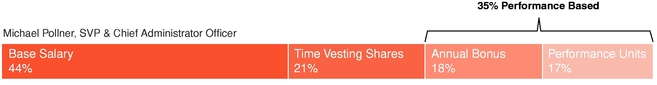

The following sets forth the primary objectives addressed by each component of our executive compensation programs:

For more information regarding our compensation, please see our Compensation Discussion and Analysis on page 39.

In response to our dialogue with stockholders during the past several years, we have incorporated a number of practices into our compensation programs:

See page 39 for more details regarding our executive compensation.

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

PROPOSAL | ||

| ||

| ||

Director Resignation Policy | ||

Code of Ethics | ||

| ||

Board Leadership Structure | ||

Oversight of Risk Management by our Board of Directors | ||

Board Diversity | ||

| ||

Compensation Committee Interlocks and Insider Participation | ||

Communications with Directors | ||

Compensation of Directors | ||

Director Compensation Table — 2017 | 22 | |

PROPOSAL 2 — APPROVAL OF THE KNOLL, INC. 2018 STOCK INCENTIVE PLAN | 24 | |

REPORT OF AUDIT COMMITTEE | 33 | |

PROPOSAL 3 — INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 34 | |

PROPOSAL 4 — ADVISORY VOTE ON EXECUTIVE COMPENSATION | 35 | |

EXECUTIVE OFFICERS | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 37 | |

EXECUTIVE COMPENSATION | ||

COMPENSATION DISCUSSION AND ANALYSIS ("CD&A") | 39 | |

How Did We Perform? | 40 | |

What Are Our Compensation Practices? | 42 | |

How Are Compensation Decisions Made? | 43 | |

How Do We Compensate Our CEO and other NEOs? | 45 | |

Tax Implications of Executive Compensation | 48 | |

2017 Compensation — Analysis | 49 | |

How Do We Manage Risks Related to Our Compensation Program? | 53 | |

Risk Assessment — Incentive Compensation Programs | 53 | |

Executive Stock Ownership Policy | 53 | |

Compensation | ||

| ||

Grants of | ||

Narrative Disclosure For Summary Compensation Table and Grants of Plan-Based Awards Table | ||

Outstanding Equity Awards at Fiscal Year-End | ||

Option Exercises and Stock Vested | ||

Pension Benefits | ||

2017 Pension Benefits | 62 | |

Potential Payments Upon Termination or | ||

Severance Under Employment | ||

Severance Pay Plan | ||

Change-in-Control Provisions | ||

Potential Post-Retirement Payments to Named Executive Officers As of December 31, | ||

| ||

| ||

TRANSACTIONS WITH RELATED PERSONS | ||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||

| ||

| ||

| ||

| ||

| ||

|

KNOLL, INC.1235 WATER STREETEAST GREENVILLE, PENNSYLVANIA 18041215-679-7991

PROXY STATEMENT FOR THE KNOLL, INC.2016 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

Why Did You Send Me this Proxy Statement?

We have elected to furnish our proxy statement and annual report to certain of our stockholders over the Internet pursuant to United States Securities and Exchange Commission (SEC) rules, which allows us to reduce costs associated with the 2016 annual meeting of stockholders. On or about March 23, 2016, we will mail to certain of our stockholders a notice of Internet availability of proxy materials containing instructions regarding how to access our proxy statement and annual report online (the eProxy Notice). The eProxy Notice contains instructions regarding how you can elect to receive printed copies of the proxy statement and annual report. All other stockholders will receive printed copies of the proxy statement and annual report, which will also be mailed to such stockholders on or about March 23, 2016.

We sent you this proxy statement because our board of directors is soliciting your proxy to vote at our 2016 Annual Meeting of Stockholders and any adjournments of the meeting. This proxy statement summarizes the information you need to know to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares via the Internet or by marking, signing, dating and returning a proxy card. If you hold your shares through a broker you may also be able to vote your shares through such broker either via the Internet or by telephone. Please contact your broker directly for details regarding these voting options.

Only stockholders who owned our common stock at the close of business on March 15, 2016, the record date, are entitled to vote at the Annual Meeting. On the record date, there were 49,034,818 shares of our common stock outstanding, including 47,963,533 shares of stock entitled to vote and 1,071,285 shares of restricted stock that are not entitled to vote. Our common stock is our only class of voting stock. We are also sending along with this proxy statement our 2015 annual report, which includes our financial statements for the fiscal year ended December 31, 2015.

You will be voting on:

Each share of our common stock that you own entitles you to one vote.

Why Did I Receive an eProxy Notice of Internet Availability of Proxy Materials?

The SEC permits us to electronically distribute proxy materials to stockholders. We have elected to provide access to our proxy materials and annual report to certain of our stockholders on the Internet instead of mailing the full set of printed proxy materials. On or about March 23, 2016, we will mail to

certain of our stockholders an eProxy Notice containing instructions regarding how to access our proxy statement and annual report and how to vote online. If you received an eProxy Notice by mail, you will not receive printed copies of the proxy materials and annual report in the mail unless you request them. Instead, the eProxy Notice instructs you how to access and review all of the important information contained in the proxy statement and annual report. The eProxy Notice also instructs you how you may submit your proxy over the Internet. If you received an eProxy Notice by mail and would like to receive a printed copy of our proxy materials and annual report, you should follow the instructions for requesting such materials included in the eProxy Notice.

You may vote via the Internet by going to the website www.envisionreports.com/KNL and following the instructions outlined on the website or via the telephone by calling 1-800-652-VOTE and following the recorded instructions. If you request paper copies of the proxy materials, you can also vote by signing and mailing your proxy card. If you properly fill in your proxy card and send it to us in time, your "proxy" (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your proxyholder will vote your shares as recommended by our board of directors. Proxy cards must be received prior to the time of the vote in order for the shares represented by the proxy card to be voted. If you hold your shares through a broker or financial institution, you should contact your broker or financial institution to determine how you may vote your shares.

If you hold your shares through a broker, it is important that you cast your vote if you want it to count in the election of directors (Proposal 1) and the advisory vote on executive compensation (Proposal 3). Your broker is not permitted to vote your uninstructed shares in the election of directors or executive compensation matters on a discretionary basis. Thus, if you hold your shares through a broker and you do not instruct your broker how to vote for Proposal 1 (the election of directors) or Proposal 3 (the advisory vote on executive compensation), no votes will be cast on your behalf with respect to those matters. Your broker may vote your uninstructed shares on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm on a discretionary basis.

If you attend the Annual Meeting, you may also submit your vote in person, and any previous votes that you submitted will be superseded by the vote that you cast at the Annual Meeting.

If you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on March 15, 2016, the record date for voting. The Annual Meeting will be held at 9:00 a.m. (local time) on Wednesday, May 4, 2016 at our offices at 1330 Avenue of the Americas, 2nd Floor, New York, New York 10019. When you arrive at the venue, signs will direct you to the appropriate meeting rooms. You need not attend the Annual Meeting in order to vote.

If you give us your proxy, you may revoke it at any time before it is voted at the meeting. You may revoke your proxy in any one of the following ways:

How Does our Board of Directors Recommend That I Vote on the Proposals?

Our board of directors recommends that you vote as follows:

If any other matter is presented, your proxyholder will vote your shares in accordance with his or her best judgment. At the time this proxy statement was printed, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

What Constitutes a Quorum for the Meeting?

The presence, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding and entitled to vote is necessary to constitute a quorum at the meeting. Votes of stockholders of record who are present at the meeting, in person or by proxy, abstentions and broker non-votes are counted for purposes of determining whether a quorum exists.

What Vote is Required to Approve Each Proposal?

| ||

|

| |

|

|

What is the Effect of Broker Non-Votes and Abstentions?

as a routine matter. The election of directors (Proposal 1) and the advisory vote to approve executive compensation (Proposal 3) are not considered routine matters and, consequently, without your voting instructions, your brokerage firm cannot vote your shares. Broker non-votes will not count as votes against any matter at the annual meeting.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Solicitation of proxies will be made principally through the mails, but our officers and employees may also solicit proxies in person or by telephone, fax or email. We will pay these employees and officers no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to the beneficial owners of the common stock and to obtain authority to execute proxies. Upon request, we will then reimburse them for their reasonable expenses.

Votes cast by proxy or in person will be counted by the persons appointed by us to act as election inspectors for the meeting.

Where Do I Find the Voting Results of the Meeting?

We will announce the preliminary voting results at the meeting and provide the final results in a Current Report on Form 8-K filed with the SEC within four business days following the meeting.

Householding of Annual Disclosure Documents

To reduce the expenses of delivering duplicate materials to our stockholders, we are relying on a rule of the Securities and Exchange Commission (the "SEC") that allows us or your broker to send a single set of our annual report and proxy statement to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as "householding," benefits both you and us. The rule applies to our annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be "householded," the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Each stockholder will continue to receive a separate proxy card or voting instruction card.

If your household received a single set of our annual disclosure documents this year, but you would prefer to receive your own copy, please contact us by writing to Knoll, Inc., c/o Corporate Secretary, 1235 Water Street, East Greenville, Pennsylvania 18041, or calling our Investor Relations department at 215-679-7991 and we will promptly send you a copy of our annual disclosure documents.

If you do not wish to participate in "householding" and would like to receive your own set of our annual disclosure documents in future years, follow the instructions described below. Conversely, if you share an address with another of our stockholders and together both of you would like to receive only a single set of our annual disclosure documents, follow these instructions:

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of February 29, 2016, for (a) the executive officers named in the Summary Compensation Table on page 31 of this proxy statement, (b) each of our directors and director nominees, (c) all of our directors and executive officers as a group, and (d) each stockholder known by us to own beneficially more than 5% of our outstanding common stock. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them, subject to community property laws, based on information provided to us by these stockholders. Percentage of ownership is based on 49,116,313 shares of common stock outstanding on February 29, 2016, including 48,045,028 shares of stock entitled to vote and 1,071,285 shares of restricted stock that are not entitled to vote.

| | Common Stock Beneficially Owned | ||||||

|---|---|---|---|---|---|---|---|

Name of Beneficial Owner | Number | Percent(1) | |||||

Stockholders owning approximately 5% or more: | |||||||

BlackRock, Inc.(2) | 3,626,845 | 7.4 | |||||

The Vanguard Group, Inc.(3) | 3,335,352 | 6.8 | |||||

FMR LLC(4) | 3,074,444 | 6.3 | |||||

Silvercrest Asset Management Group, LLC(5) | 2,849,453 | 5.8 | |||||

Columbia Wanger Asset Management, LLC(6) | 2,833,410 | 5.8 | |||||

T. Rowe Price Associates, Inc.(7) | 2,688,580 | 5.5 | |||||

Directors and Executive Officers: | |||||||

Burton B. Staniar(8) | 139,685 | * | |||||

Andrew B. Cogan(9) | 278,669 | * | |||||

Craig B. Spray(10) | 23,248 | * | |||||

Joseph T. Coppola(11) | * | * | |||||

Benjamin A. Pardo(12) | 13,625 | * | |||||

Pamela J. Ahrens(13) | 4,233 | * | |||||

Jeffrey A. Harris(14)(15) | 81,427 | * | |||||

Sidney Lapidus(14)(16) | 180,017 | * | |||||

Kathleen G. Bradley(14) | 113,447 | * | |||||

John F. Maypole(14) | 29,349 | * | |||||

Stephen F. Fisher(14) | 40,605 | * | |||||

Sarah E. Nash(14)(16) | 50,796 | * | |||||

Stephanie Stahl(14) | 3,565 | * | |||||

Christopher G. Kennedy(17) | 8,604 | * | |||||

All directors and executive officers as a group (18 persons)(18) | 1,069,696 | 2.2 | |||||

Management Group, LLC, Columbia Wanger Asset Management, L.P., and T. Rowe Price Associates, Inc., is based on the latest Schedule 13G report or amendment thereto that each has filed as of the date of this proxy statement.

PROPOSAL 1—1: ELECTION OF DIRECTORS

Our board of directors currently consists of teneleven members, classified into three classes as follows: Andrew B. Cogan, Stephen F. Fisher and Sarah E. Nash constitute a class with a term that expires at the 20172020 Annual Meeting (the "Class I directors"); Burton B. Staniar, Sidney Lapidus, Stephanie Stahl, and Christopher G. Kennedy and Daniel W. Dienst constitute a class with a term that expires at the 2018 Annual Meeting (the "Class II directors"); and Kathleen G. Bradley, Jeffrey A. Harris and John F. Maypole constitute a class with a term that expires at the 20162019 Annual Meeting (the "Class III directors"). At each Annual Meeting of Stockholders, directors are elected for a term ending at the third Annual Meeting of Stockholders after such election or until their respective successors are elected and qualified.

On February 9, 2016,6, 2018, our nominating and corporate governance committee recommended Messrs. HarrisStephanie Stahl, Christopher G. Kennedy and Maypole and Ms. BradleyDaniel W. Dienst for reelectionre-election after due consideration of their qualifications and past experience on our board of directors. Messrs. Staniar and Lapidus have not been asked to continue their service beyond the conclusion of their terms and the size of the board will be reduced to nine members. On February 9, 2016,6, 2018, based, in part, on the recommendation of our nominating and corporate governance committee, our board of directors voted to nominate Messrs. HarrisStephanie Stahl, Christopher G. Kennedy, and Maypole and Ms. BradleyDaniel W. Dienst for reelection at the 20162018 Annual Meeting of Stockholders to serve for a term ending at the 20192021 Annual Meeting of Stockholders.Stockholders or until their respective successors are elected and qualified.

Unless authority to vote for any of these nominees is withheld, the shares represented by the enclosed proxy will be votedFOR the election of the director nominees. However, if you hold your shares through a broker and do not instruct your broker how to vote in the election of directors, no vote will be cast on your behalf with respect to Proposal 1. In the event that a nominee becomes unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the board of directors may recommend in his or her place. We have no reason to believe that any nominee will be unable or unwilling to serve as a director. However, if you hold your shares through a broker and do not instruct your broker how to vote in the election of directors, no vote will be cast on your behalf with respect to Proposal 1.

The election of directors will be determined by a plurality vote and the three nominees receiving the most votes will be elected, subject to our majority vote director resignation policy which is discussed in more detail below.

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF JEFFREY A. HARRIS, JOHN F. MAYPOLESTEPHANIE STAHL, CHRISTOPHER G. KENNEDY AND KATHLEEN G. BRADLEYDANIEL W. DIENST AS DIRECTORS, AND PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

| YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ALL NOMINEES |

Our Board of Directors

Set forth below are the names of the persons nominated as directors and directors whose terms do not expire this year, their ages as of February 29, 2016,28, 2018, their offices within the company, if any, their principal occupations or employment for the past five years, the length of their tenure as directors, the names of other public companies in which such persons hold directorships or held directorships within

the past five years, and the particular experience, qualifications, attributes or skills that led the boardBoard to determine that the individual should serve as a director.

| NAME | AGE | POSITION | TERM EXPIRATION | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| Kathleen G. Bradley | 68 | Director | 2019 Annual Meeting | |||

Andrew B. Cogan | 55 |

| 2020 Annual Meeting | |||

Daniel W. Dienst | 52 |

| 2018 Annual Meeting | |||

Stephen F. Fisher | 65 |

| 2020 Annual Meeting | |||

Jeffrey A. Harris | 62 |

| 2019 Annual Meeting | |||

Christopher G. Kennedy | 54 |

| 2018 Annual Meeting | |||

John F. Maypole | 78 |

| 2019 Annual Meeting | |||

Sarah E. Nash | 64 |

| 2020 Annual Meeting | |||

Stephanie Stahl | 51 |

| 2018 Annual Meeting |

| Director Since:1999 Committee Memberships: Audit | |||||||

| Independent Director Biography Kathleen G. Bradley has served as a director of Knoll, Inc. since November 1999. Ms. Bradley served as President and Chief Executive Officer, Knoll | |||||||

| | | | | | | | | |

| | ||||||||

| Skills and Qualifications Ms. Bradley has exceptional industry knowledge and a deep understanding of Knoll's business, having been associated with Knoll for over 35 years, including over seven years as President and Chief Executive Officer of Knoll, North America, and more than 20 years in numerous management positions. Ms. Bradley's experience has included managing regional divisions and key parts of the organization such as sales and distribution, and customer service. Ms. Bradley also served on the board of our industry trade organization, The Business and Institutional Furniture Manufacturer's Association. Ms. Bradley's in-depth knowledge of our business and her extensive management experience are important aspects of her service on the Board. | |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

Burton B. Staniar has served as Chairman of the Board of Knoll, Inc. since his appointment in December 1993. Mr. Staniar served as our Chief Executive Officer from December 1993 to January 1997. Prior to that time, Mr. Staniar held a number of assignments at Westinghouse Electric Corporation, including President of Group W Cable and Chairman and Chief Executive Officer of Westinghouse Broadcasting. Mr. Staniar previously served as a director of Journal Register Company and Church and Dwight Co., Inc.

Mr. Staniar has been associated with Knoll since 1993 and brings to the board extensive knowledge of our business operations and the contract office furniture industry as a whole. Mr. Staniar also brings to the board significant executive leadership and operational experience, having previously served in senior executive roles with subsidiaries of Westinghouse Electric Corporation and as Chairman and CEO of Westinghouse Broadcasting. Mr. Staniar also previously served on numerous public boards and currently serves as a board member for a number of non-profit organizations. Mr. Staniar's prior business experience and board service, along with his long tenure with Knoll, give him broad and extensive understanding of our operations and the proper role and function of the board.

Andrew B. Cogan has served as a director of Knoll, Inc. since February 1996. Mr. Cogan became Chief Executive Officer of Knoll, Inc. in April 2001 after serving as Chief Operating Officer since December 1999. Mr. Cogan has held several positions in the design and marketing group worldwide since joining us in 1989, including Executive Vice President—Marketing and Product Development and Senior Vice President. Mr. Cogan is also a director of the Chinati Foundation in Marfa, Texas, Interface, Inc. in Atlanta, Georgia, and American Woodmark Corporation in Winchester, Virginia.

Mr. Cogan has substantial industry and management experience, having served in management functions at Knoll for more than 20 years and as our Chief Executive Officer since 2001. Mr. Cogan is uniquely qualified to bring strategic insight, design and marketing expertise and in-depth knowledge of Knoll's worldwide business to the board, having served in numerous key positions within our design and marketing group, and as Chief Operating Officer prior to becoming Chief Executive Officer. In addition to his management experience, Mr. Cogan brings to the board his perspectives as a director of other private and public boards.

Kathleen G. Bradley has served as a director of Knoll, Inc. since November 1999. Ms. Bradley served as President and Chief Executive Officer, Knoll North America, from April 2001 until her retirement on May 23, 2008. Prior to that time she served as President from December 1999 to April 2001, Executive Vice President—Sales, Distribution and Customer Service from August 1998 until December 1999, Senior Vice President from 1996 until August 1998 and Divisional Vice President for Knoll's southeast division from 1988 until 1996. Prior to that time, Ms. Bradley was regional manager

| | Director Since:1996 Committee Memberships: None | | ANDREW B. COGAN President and Chief Executive Officer Biography Andrew Cogan has served as a director of Knoll, Inc. since February 1996. Mr. Cogan became Chief Executive Officer of Knoll, Inc. in April 2001 after serving as Chief Operating Officer since December 1999. Mr. Cogan has held several positions in the design and marketing group worldwide since joining us in 1989, including Executive Vice President—Marketing and Product Development and Senior Vice President. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Cogan has substantial industry and management experience, having served in management functions at Knoll for more than 20 years and as our Chief Executive Officer since 2001. Mr. Cogan is uniquely qualified to bring strategic insight, design and marketing expertise and in-depth knowledge of Knoll's worldwide business to the board, having served in numerous key positions within our design and marketing group, and as Chief Operating Officer prior to becoming Chief Executive Officer. Mr. Cogan is also a director of the Chinati Foundation in Marfa, Texas, Interface, Inc. in Atlanta, Georgia, and American Woodmark Corporation in Winchester, Virginia. |

for our Atlanta region, a position to which she was promoted in 1983. She began her career with Knoll in 1979.

| | Director Since:2017 Committee Memberships: None | | DANIEL W. DIENST Independent Director Biography Daniel W. Dienst joined us as a director in August 2017. Mr. Dienst has been a Principal of D2Quared, LLC, a consulting firm, since 2013. He previously served as a Director and Chief Executive Officer of Martha Stewart Living Omnimedia, Inc. until its December 2015 sale to Sequential Brands, Inc. Prior to that, Mr. Dienst served as the Group Chief Executive of Sims Metal Management, Ltd., the world's largest publicly-listed metal and electronics recycler from 2008 to 2013. Prior to that, Mr. Dienst held various positions with CIBC World Markets Corp., a diversified global financial services firm. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Dienst has substantial financial and executive experience and brings his strategic insight and financial acumen to the board's deliberations given his prior experience as a chief executive officer of a public company. |

Ms. Bradley has exceptional industry knowledge and a deep understanding of Knoll's business, having been associated with Knoll for over 35 years, including over seven years as President and Chief Executive Officer of Knoll, North America, and more than 20 years in numerous management positions. Ms. Bradley's experience has included managing regional divisions and key parts of the organization such as sales and distribution, and customer service. Ms. Bradley also served on the board of our industry trade organization, The Business and Institutional Furniture Manufacturer's Association. Ms. Bradley's in-depth knowledge of our business and her extensive management experience are important aspects of her service on the Board.

Jeffrey A. Harris has been a director of Knoll, Inc. since February 1996. Mr. Harris is the founder and managing member of Global Reserve Group LLC, a financial advisory and investment firm focused primarily on the energy industry. Previously, he was a Managing Director of Warburg Pincus LLC, a private equity firm, where he was employed from 1983 until 2011 where his responsibilities included involvement in investments in energy, technology and other industries. Mr. Harris is a director of Serica Energy PLC and several private companies. In addition, he is a member of the Board of Trustees of the Cranbrook Educational Community, New York-Presbyterian Hospital and Friends of the High Line. Mr. Harris previously served as a director of Electromagnetic GeoServices ASA.

Mr. Harris brings a strong business background to Knoll, having worked in the private equity field with Warburg Pincus for over 25 years. Mr. Harris has gained substantial experience in overseeing the management of diverse organizations, having served as a board member on many public and private boards, including a number of charitable and non-profit organizations. As a result of this service, Mr. Harris has a broad understanding of the operational, financial and strategic issues facing public and private companies. He has served on our board of directors since 1996 and through that service has developed extensive knowledge of our business.

Sidney Lapidus has been a director of Knoll, Inc. since February 1996. Mr. Lapidus is a Retired Partner of Warburg Pincus LLC, a private equity firm, where he was employed from 1967 to 2007. Mr. Lapidus is a director of Lennar Corporation, as well as a number of non-profit organizations. Mr. Lapidus previously served as a director of The Neiman Marcus Group, Inc.

Mr. Lapidus spent over 40 years with Warburg Pincus, working principally in the private equity field. During those 40 years, Mr. Lapidus developed extensive business, finance and management skills, which he brings to the board's deliberations. Mr. Lapidus also brings to the board his experience in overseeing the management of diverse organizations, having served as a board member on many public and private boards, including a number of charitable and non-profit organizations. Mr. Lapidus' involvement in a variety of businesses has given him a broad understanding of the operational, financial and strategic issues facing public and private companies. He has served on our board of directors since 1996, and through that service has developed extensive knowledge of our business.

John F. Maypole has served as a director of Knoll, Inc. since December 2004. Mr. Maypole has, for over 30 years, served as an independent director of, or consultant to, various corporations and providers of financial services. Mr. Maypole is a director of the National Captioning Institute, Inc. Mr. Maypole previously served as a director of Church and Dwight Co., Inc., Verizon Communications and the MassMutual Financial Group, among others.

Mr. Maypole brings substantial accounting, finance, and management experience to the board. Mr. Maypole previously served as a chief financial officer, chief operating officer, chief executive officer, chairman of the board and independent consultant to numerous industrial and financial services companies and has significant experience with operational and financial matters, including financial reporting. Mr. Maypole has served on a number of private and public boards and his experiences have

| | Director Since:2005 Committee Memberships: Audit; Nominating and Corporate Governance | | STEPHEN F. FISHER Independent Director Biography Stephen F. Fisher has served as a director since December 2005. Mr. Fisher served as the Executive Vice President and Chief Financial Officer of Entercom Communications Corp., a radio broadcasting company, from November 1998 until April 28, 2017. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Fisher has held numerous financial management and operational positions. He has served as Executive Vice President and Chief Financial Officer for a public company for over 17 years. Mr. Fisher has also worked in the private equity field, making investments in companies and managing those portfolio companies as well as serving on the board of directors of both public and private companies. He brings significant financial and operational management, as well as financial reporting, experience to the board. |

resulted

| | Director Since:1996 Committee Memberships: Compensation; Nominating and Corporate Governance | | JEFFREY A. HARRIS Independent Director Biography Jeffrey A. Harris has been a director of Knoll, Inc. since February 1996. Mr. Harris is the founder and managing member of Global Reserve Group LLC, a financial advisory and investment firm focused primarily on the energy industry. Previously, he was a Managing Director of Warburg Pincus LLC, a private equity firm, where he was employed from 1983 until 2011 where his responsibilities included involvement in investments in energy, technology and other industries. Mr. Harris is a director of several private companies. In addition, he is a member of the Board of Trustees of the Cranbrook Educational Community, New York-Presbyterian Hospital and Friends of the High Line. Mr. Harris previously served as a director of Electromagnetic GeoServices ASA and Serica Energy PLC. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Harris brings a strong business background to Knoll, having worked in the private equity field with Warburg Pincus for over 25 years. Mr. Harris has gained substantial experience in overseeing the management of diverse organizations, having served as a board member on many public and private boards, including a number of charitable and non-profit organizations. As a result of this service, Mr. Harris has a broad understanding of the operational, financial and strategic issues facing public and private companies. He has served on our board of directors since 1996 and through that service has developed extensive knowledge of our business. |

| | Director Since:2014 Committee Memberships: Compensation | | CHRISTOPHER G. KENNEDY Independent Director Biography Christopher G. Kennedy joined us as a director in November 2014. Mr. Kennedy serves as Chairman of Joseph P. Kennedy Enterprises, Inc., which is the investment firm of the Kennedy Family. Mr. Kennedy also serves on the Board of Directors of Interface, Inc., a floor covering company, and is the Founder and Chairman of Top Box Foods, a Chicago-based non-profit hunger-relief organization. He formerly served as President of Merchandise Mart Properties, Inc., a subsidiary of Vornado Realty Trust, from 2000 to 2011. Since 1994, he has served on the Board of Trustees of Ariel Mutual Funds. Mr. Kennedy is also active in several educational and civic organizations. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Kennedy has significant experience in the residential and commercial furniture markets, due to his experience as former President of Merchandise Mart Properties. Mr. Kennedy also brings substantial executive level experience that is particularly beneficial to our strategies and sales and marketing efforts in the corporate office and retail market segments. His insight into governmental and economic affairs and his civic involvement also are of great value to the Knoll board. |

Stephen F. Fisher has served as a director since December 2005. Mr. Fisher is the Executive Vice President and Chief Financial Officer of Entercom Communications Corp., a radio broadcasting company, a position he has held since November 1998. Mr. Fisher also is a director of the National Association of Broadcasters.Contents

Mr. Fisher has held numerous financial management and operational positions. He has served as executive vice president and chief financial officer for a public company for over 17 years. Mr. Fisher has also worked in the private equity field, making investments in companies and managing those portfolio companies as well as serving on

| | Director Since:2004 Committee Memberships: Audit; Nominating and Corporate Governance | | JOHN F. MAYPOLE Independent Director Biography John F. Maypole has served as a director of Knoll, Inc. since December 2004. Mr. Maypole has, for over 30 years, served as an independent director of, or consultant to, various corporations and providers of financial services. Mr. Maypole is a director of the National Captioning Institute, Inc. Mr. Maypole previously served as a director of Church and Dwight Co., Inc., Verizon Communications and the MassMutual Financial Group, among others. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Maypole brings substantial accounting, finance, and management experience to the board. Mr. Maypole previously served as a chief financial officer, chief operating officer, chief executive officer, chairman of the board and independent consultant to numerous industrial and financial services companies and has significant experience with operational and financial matters, including financial reporting. Mr. Maypole has served on a number of private and public boards and his experiences have resulted in a broad understanding of the operational, financial and strategic issues facing public and private companies. Mr. Maypole's perspectives on executive management, leadership and financial management are important to the board's deliberations. |

| | Director Since:2006 Committee Memberships: Audit; Compensation | | SARAH E. NASH Independent Director Biography Sarah E. Nash has served as a director of Knoll, Inc. since September 2006. In August 2005, Ms. Nash retired as a Vice Chairman of J.P. Morgan Chase & Co.'s Investment Bank where she was responsible for the firm's client relationships. Prior to these responsibilities, she was the Regional Executive and Co-Head of Investment Banking for North America at J.P. Morgan Co. Ms. Nash serves on the Board of Directors of Irving Oil Company, Blackbaud Inc. and HBD Industries. She is a Trustee for New York-Presbyterian Hospital and is a member of the National Board of the Smithsonian Institution. Ms. Nash previously served as a director of Pathmark Stores, Inc., AbitibiBowater Inc. and Merrimack Pharmaceuticals, Inc. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Ms. Nash has significant finance and investment banking experience, and brings that experience and her perspectives on management and finance to the Knoll board. She had a long, successful career in investment banking, retiring as Vice Chairman of J.P. Morgan Chase & Co.'s Investment Bank. Ms. Nash has served on a number of private and public boards, which has resulted in a broad understanding of the operational, financial and strategic issues facing public and private companies. She brings these experiences and understandings to the Knoll board. |

Sarah E. Nash has served as a director of Knoll, Inc. since September 2006. In August 2005, Ms. Nash retired as a Vice Chairman of J.P. Morgan Chase & Co.'s Investment Bank where she was responsible for the firm's client relationships. Prior to these responsibilities, she was the Regional Executive and Co-Head of Investment Banking for North America at J.P. Morgan Co. Ms. Nash serves on the Board of Directors of Irving Oil Company, Blackbaud Inc. and HBD Industries. She is a Trustee for New York-Presbyterian Hospital and is a member of the National Board of the Smithsonian Institution and on the Business Leadership Council of CUNY. Ms. Nash previously served as a director of Pathmark Stores, Inc., AbitibiBowater Inc. and Merrimack Pharmaceuticals, Inc.Contents

Ms. Nash has significant finance and investment banking experience, and brings that experience and her perspectives on management and finance to the Knoll board. She had a long, successful career in investment banking, retiring as Vice Chairman of J.P. Morgan Chase & Co.'s Investment Bank. Ms. Nash has served on a number of private and public boards, which has resulted in a broad understanding of the operational, financial and strategic issues facing public and private companies. She brings these experiences and understandings to the Knoll board.

Stephanie Stahl joined us as a director in August 2013. Ms. Stahl is the CEO of Apprécier LLC, a company she co-founded in June 2015. Prior to that, Ms. Stahl served as Executive Vice President, Marketing and Strategy for Coach, Inc., a position she held from July 2013 until February 2015. Prior to that, Ms. Stahl served as the Senior Vice President, Strategy and Consumer for Coach from October 2012 until June 2013. Prior to joining Coach, Ms. Stahl was the Chief Executive Officer of the fitness company Tracy Anderson Mind and Body from July 2011 until July 2012. Prior to that, Ms. Stahl served as Executive Vice President and Chief Marketing Officer of Revlon and as a Partner and Managing Director of the Boston Consulting Group in the consumer goods, retail and media industries for over ten years.

Ms. Stahl has significant experience in high-design businesses and in creating and driving global brand building consumer and customer strategies, particularly in the consumer goods and retail segments. Ms. Stahl brings this experience to the board as Knoll positions itself as the premier high design company in the interior space through expanded luxury offerings and new distribution channels.

Christopher G. Kennedy joined us as a director in November 2014. Mr. Kennedy serves as Chairman of Joseph P. Kennedy Enterprises, Inc., which is the investment firm of the Kennedy Family. Mr. Kennedy also serves on the Board of Directors of Interface, Inc., a floor covering company, and is the Founder and Chairman of Top Box Foods, a Chicago-based non-profit hunger-relief organization. He formerly served as President of Merchandise Mart Properties, Inc., a subsidiary of Vornado Realty Trust, from 2000 to 2011. Since 1994, he has served on the Board of Trustees of Ariel Mutual Funds. Mr. Kennedy is also active in several educational and civic organizations.

| | Director Since:2013 Committee Memberships: Nominating and Corporate Governance | | STEPHANIE STAHL Independent Director Biography Stephanie Stahl joined us as a director in August 2013. Ms. Stahl is the CEO of Apprécier LLC, a company she co-founded in June 2015. Prior to that, Ms. Stahl served as Executive Vice President, Marketing and Strategy for Coach, Inc., a position she held from July 30, 2013 until February 14, 2015. Prior to that, Ms. Stahl served as the Senior Vice President, Strategy and Consumer for Coach from October 2012 until June 2013. Prior to joining Coach, Ms. Stahl was the Chief Executive Officer of the fitness company Tracy Anderson Mind and Body from July 2011 until July 2012. Prior to that, Ms. Stahl served as Executive Vice President and Chief Marketing Officer of Revlon and as a Partner and Managing Director of the Boston Consulting Group in the consumer goods, retail and media industries for over ten years. Ms. Stahl also serves on the Board of Directors of Dollar Tree Stores. | |||||

| | | | | | | | | |

| | | | Skills and Qualifications Ms. Stahl has significant experience in high-design businesses and in creating and driving global brand building consumer and customer strategies, particularly in the consumer goods and retail segments. Ms. Stahl brings this experience to the board as Knoll positions itself as the premier high-design company in the interior space through expanded luxury offerings and new distribution channels. |

In accordance with our Corporate Governance Guidelines, our board of directors has reviewed the qualifications of each of its members and, on February 27, 2018, affirmatively determined that a majority of the members of our board of directors are independent under the New York Stock Exchange ("NYSE") Corporate Governance Standards. The independence standards of the NYSE are composed of objective standards and subjective standards. Under the objective standards, a director will generally not be deemed independent if he or she receives compensation (other than as a director) in excess of certain thresholds or if certain described relationships exist. Under the subjective standards, a director will not be independent if the board of directors determines that the director has a material relationship with us. In addition to our board of directors determining these directors meet the objective standards under the listing standards of the NYSE, our board of directors has determined that none of these individuals has a material relationship with the company (directly or as a partner, shareholder, or officer of an organization that has a relationship with the company) other than as a director. In making this determination, the board of directors considered that some of the directors serve on boards of companies, or are (or recently were) associated with companies or entities, to which we sold products, or from which we purchased products or services during the year. Given the size and nature of these transactions, we concluded that they would not interfere with the exercise of independent judgment by these board members. The board of directors relied on both information provided by the directors and information developed internally by the company in evaluating these facts. In the case of Mr. Kennedy, the board of directors also considered that one of Mr. Kennedy's siblings is a partner in a New York-based film production company with the sister-in-law of our chief executive officer and determined that this relationship was not material.

The Board has significant experiencedetermined that each of the following directors and director nominees listed below is independent under the independence standards of the New York Stock Exchange and would constitute a majority of the board of directors:

In addition, the board determined that each member of the Audit Committee also meets the additional independence standards for audit committee members established by the Securities and Exchange Commission ("SEC") and the NYSE, and each member of the Compensation Committee meets the additional independence standards for compensation committee members established by the SEC and the NYSE, and also qualifies as a "Non-Employee Director" as defined in Rule 16b-3 of the residentialExchange Act.

Our Corporate Governance Policies and commercial furniture markets, due to his experience as former President of Merchandise Mart Properties. Mr. Kennedy also brings substantial executive level experience that is particularly beneficial to our strategies and sales and marketing efforts in the corporate office and retail market segments. His insight into governmental and economic affairs and his civic involvement also are of great value to the Knoll board.Practices

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that provide the framework for the governance of the company. Our Corporate Governance Guidelines are available on our website at

www.knoll.com and will also be made available to stockholders without charge upon request in writing to our Corporate Secretary at Knoll, Inc., 1235 Water Street, East Greenville, Pennsylvania 18041. The information contained on our website is not included as part of, or incorporated by reference into, this proxy statement.

Our Corporate Governance Guidelines include a Director Resignation Policy, adopted in 2014.Policy. Under this policy, any nominee for director in an uncontested election (i.e., an election where the only nominees are those proposed by the board) who receives a greater number of votes "withheld" from his or her election than votes "for" such election shall promptly tender an offer of resignation for consideration by the board. The nominating and corporate governance committee shall evaluate the director's offer of resignation, taking into account the best interests of the Company and its stockholders, and shall recommend to the board whether to accept or reject such offer of resignation. In making this recommendation, the nominating and corporate governance committee may consider all factors deemed relevant by its members, including, without limitation, the underlying reasons why stockholders voted against the director (if ascertainable), the length of service and qualifications of the director, the director's past (and expected future) contributions to the Company, and whether by accepting such resignation the Company will no longer be in compliance with any applicable law, rule, regulation or governing document. The board shall act to accept or reject such offer of resignation within 120 days following certification of the stockholder vote at the stockholder meeting at which the election of directors was held. In making its decision, the board may consider the factors considered by the committee and such additional information and factors the board believes to be relevant.

Our board of directors has adopted a Codecode of Ethicsethics that applies to all of our directors, officers and employees, including our chief executive officer and chief financial and accounting officers. The Codecode of Ethicsethics is publicly available on our website atwww.knoll.com and will also be made available without charge to any person upon request in writing to our Corporate Secretary at Knoll, Inc., 1235 Water Street, East Greenville, Pennsylvania 18041. We intend to disclose amendments to, or waivers from, provisions of the code of ethics that apply to any director or principal executive, financial or accounting officers on our website atwww.knoll.com, in lieu of disclosing such matters in Current Reports on Form 8-K.

In accordance with our Corporate Governance Guidelines, our board of directors has reviewed the qualifications of each of its members and, on February 29, 2016, affirmatively determined that Messrs. Maypole, Fisher, Harris, Lapidus and Kennedy and Ms. Bradley, Ms. Nash and Ms. Stahl, a majority of the members of our board of directors, are independent. The independence standards of the New York Stock Exchange are composed of objective standards and subjective standards. Under the objective standards, a director will generally not be deemed independent if he or she receives

compensation (other than as a director) in excess of certain thresholds or if certain described relationships exist. Under the subjective standards, a director will not be independent if the board of directors determines that the director has a material relationship with us. In addition to our board of directors determining these directors meet the objective standards under the listing standards of the New York Stock Exchange, our board of directors has determined that none of these individuals has a material relationship with the company (directly or as a partner, shareholder, or officer of an organization that has a relationship with the company) other than as a director. In making this determination, the board of directors considered the fact that some of the directors serve on boards of companies, or are (or recently were) associated with companies or entities, to which we sold products, or from which we purchased products or services during the year. Given the size and nature of these transactions, we concluded that they would not interfere with the exercise of independent judgment by these board members. The board of directors relied on both information provided by the directors and information developed internally by the company in evaluating these facts. In the case of Mr. Kennedy, the board of directors also considered the fact that one of Mr. Kennedy's siblings is a partner in a New York-based film production company with the sister-in-law of our chief executive officer and determined that this relationship was not material.

We currently have a separate chief executive officer, chairman of the board, and lead independent director. We do not have a formal policy on whetherdirector; however, this structure will be changing at the same person should (or should not) serve as both the chief executive officer and chairman2018 annual meeting of stockholders. Andrew B. Cogan has been elected Chairman of the board; however, givenBoard, effective May 8, 2018, upon the conclusion of Burton B. Staniar's term. Mr. Cogan has served as our CEO since 2001, and originally joined us in 1989. Given the current composition of the board, we generally believe that different people shouldit is appropriate for Mr. Cogan to hold theboth positions of chairman of the board and chief executive officer. officer in light of the depth of his experience with the company and in our industry generally.

Additionally, we believe that when the chairman of the board is an employee of the company or otherwise not independent, it is important to have a separate lead independent director in order to facilitate the board's oversight of management.

Mr. Staniar has served as our chairman since 1993, and served as our chief executive officer from 1993 until 1997. In serving as chairman, Mr. Staniar serves as a significant resource for our chief executive officer, Mr. Cogan, other members of management and perform many of the board of directors. We believesame functions that the depth of leadership and the significant experience provided by Messrs. Cogan and Staniar in their respective roles asan independent chairman and chief executive officer has benefited Knoll significantly.

Mr. Staniar spends a significant amount of his time involved with day-to-day activities at the company, primarily working with customers and potential customers, but also assisting us with other senior management activities. As a result of this involvement (and the monetary payment he receives for his services), Mr. Staniar is not considered "independent" under applicable New York Stock Exchange listing standards. Accordingly, we also have a lead director who is "independent".

Mr.would perform. Jeffrey A. Harris serves as our lead independent director. In that role, he presides over the board's executive sessions and serves as the principal liaison between management and the independent directors of our board. Mr. Harris has served as a Knoll director since 1996.

We believe that the combination of Mr. Staniar as our chairman and Mr. Harris as our lead director has been an effective structure for Knoll. The division of duties and the additional avenues of communication between the board and our management associated with having Mr. StaniarCogan serve as chairman and Mr. Harris as lead director provides the basis for the proper functioning of our board and its oversight of management.

Oversight of Risk Management by our Board of Directors

Our board of directors has overall responsibility for risk oversight. This role is primarily fulfilled by our audit committee. Our audit committee periodically discusses and evaluates company risk with our management, including our chief executive officer, chief financial officer and our chief legal officer.

Our audit committee also periodically discusses and evaluates risk with our independent auditors and members of our internal audit group. The audit committee reports back to our full board with respect to those activities. In addition, as described in the section entitled "Compensation Risk""Risk Assessment — Incentive Compensation Programs" on page 4353 below, our compensation committee specifically evaluates risks associated with our compensation programs. The board's role in risk oversight has not had any effect on the board's leadership structure.

Diversity is one of the factors considered by our nominating and corporate governance committee in the director nomination process. The overriding principle guiding our director nomination process is a desire to ensure that our board as a whole collectively serves the interests of our stockholders. We believe that having diverse skills, experiences and perspectives represented on the board provides the most value to the company and its stockholders. We also believe that an appropriate level of collegiality and chemistry among board members is extremely important to a well functioningwell-functioning board.

Among the factors considered when we evaluate the skills, experiences and perspectives are the following:

We also consider diversity with respect to race and gender in evaluating whether the board as a whole has the right mix of perspectives to properly serve the company and its stockholders.

All of the factors set forth above are considered by the nominating and corporate governance committee as it evaluates the directors that are nominated to serve on our board. It is not our desire to make sure every skill, type of experience and perspective is represented on the board, but we instead focus on making sure there is an appropriate mix of skills, experiences and perspectives, which we believe leads to more thoughtful and open board discussions and deliberations. Our nominating and corporate governance committee monitors its consideration of diversity as part of the annual self-evaluation process.

During the year ended December 31, 2015,2017, there were four meetings of our board of directors. During 2015,2017, no director attended fewer than 75% of the total number of meetings or fewer than 75% of meetings of a committee of the board on which he or she served. Currently, we do not have a formal policy regarding director attendance at our Annual Meetings of Stockholders. However, it is expected that, absent compelling circumstances, our directors will be in attendance at our 20162018 Annual Meeting of Stockholders. All of our directors except for Mr. Kennedy attended our 20152017 Annual Meeting of Stockholders.

In accordance with our Corporate Governance Guidelines, our non-management directors meet periodically without any management directors or employees present. As required by the New York Stock Exchange Listing requirements and in accordance with our Corporate Governance Guidelines,

our independent directors also meet exclusively in an executive session at least once a year. Mr. Harris presides over meetings of the non-management directors and independent directors.

Our board of directors maintains an audit committee, a compensation committee, and a nominating and corporate governance committee. Each of these committees operates pursuant to a written charter, which are reviewed annually and publicly available on our website atwww.knoll.com and will also be made available to stockholders without charge, upon request in writing to our Corporate Secretary at Knoll, Inc., 1235 Water Street, East Greenville, Pennsylvania 18041.

Audit Committee. Our audit committee met eightnine times during 2015.2017. This committee currently has four members, Messrs. Fisher and Maypole and Ms. Nash and Ms. Bradley. Our board of directors has determined that Mr. Maypole, the Chairman of the audit committee, is an "audit committee financial expert," as the SEC has defined that term in Item 407 of Regulation S-K. The composition of our audit committee meets the currently applicable independence requirements of the New York Stock Exchange and SEC rules and regulations. Our audit committee (i) assists our board in monitoring the integrity of our financial statements, our compliance with legal and regulatory requirements, our independent registered public accounting firm's qualifications and independence, and the performance of our internal audit function and independent registered public accounting firm; (ii) assumes direct responsibility for the appointment, compensation, retention and oversight of the work of any independent registered public accounting firm engaged for the purpose of performing any audit, review or attest services and for dealing directly with any such accounting firm; (iii) provides a medium for consideration of matters relating to any audit issues; and (iv) prepares the audit committee report that the SEC rules require be included in our annual proxy statement or annual report on Form 10-K. The audit committee reviews and evaluates, at least annually, its performance and the performance of its members, including compliance with its charter. Please see the report of the audit committee set forth elsewhere in this proxy statement.

Compensation Committee. Our compensation committee met fivesix times during 2015.2017. This committee currently has four members, Messrs. Harris, Lapidus and Kennedy and Ms. Nash. Mr. Harris serves as Chairman of the committee. Our compensation committee reviews and recommends policy relating to compensation and benefits of our officers and employees, including reviewing and approving corporate goals and objectives relevant to compensation of the chief executive officer and other senior officers, evaluating the performance of these officers in light of those goals and objectives and setting compensation of these officers based on such evaluations. Our chief executive officer generally makes recommendations to the compensation committee regarding executive compensation matters. Our board of directors has designated our compensation committee to serve as the administrative committee under our stock incentive plans. In that role, our compensation committee determines which individuals receive awards under our stock incentive plans, the types of such awards, the terms and conditions of such awards and, subject to our stock option grant policy, the time at which such awards are granted. The compensation committee reviews and evaluates, at least annually, the performance of the compensation committee and its members, including compliance of the compensation committee with its charter. A description of the compensation committee's processes and procedures for the consideration and determination of executive compensation is set forth in more detail below in this Proxy Statement under the heading "Compensation Discussion and Analysis."